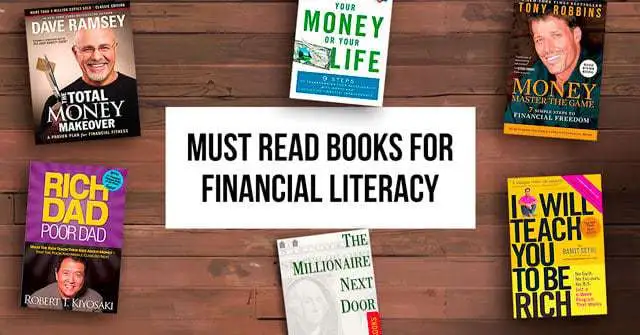

As 2024 unfolds, enhancing financial literacy remains a top priority for many. In an era where financial education is crucial for success, books are a timeless resource that offer deep insights and practical advice. This article presents a curated list of essential financial books to read in 2024, each selected for its potential to transform your understanding and management of money.

Key Takeaways

These books are selected to enhance financial literacy and success.

Each book offers unique insights into managing and growing your wealth.

They provide practical advice that can be applied to personal finances.

Reading these books can be a transformative step towards financial empowerment.

The list includes a mix of classic and contemporary financial literature.

1. The Richest Man in Babylon by George S. Clason

Published in 1926, ‘The Richest Man in Babylon’ remains a cornerstone in financial literature, offering timeless wisdom through captivating parables from ancient Babylon. The book is a masterpiece in teaching the art of managing money, showcasing principles like saving a portion of your income, investing wisely, and living within one’s means.

Key Lessons:

Save at least 10% of your income: This fundamental rule is as relevant today as it was in ancient times.

Invest wisely: Understand where you’re putting your money and seek advice from those who are competent.

Live within your means: Avoid the trap of lifestyle inflation that can lead to financial distress.

These simple yet profound lessons are conveyed through engaging historical anecdotes, making it not just an educational read but also an enjoyable one. The principles taught are not just about accumulating wealth but also about achieving financial independence and security.

2. The Intelligent Investor by Benjamin Graham

The Intelligent Investor is more than just a book; it’s a comprehensive guide to value investing, crafted by the legendary Benjamin Graham. Often referred to as the ‘Father of Value Investing,’ Graham’s principles have guided investors through the complexities of the market with a focus on long-term, sustainable growth. This book is essential for anyone looking to understand the fundamentals of investing without being swayed by market fluctuations.

Key Principles:

Long-term thinking

Margin of safety

Diligent research

This book is a must-have on your shelf if you aspire to navigate the stock market with poise and confidence.

The Intelligent Investor stands out for its timeless approach to investing, emphasizing that a well-thought-out strategy is more crucial than the noise of the market. It’s a vital read for both novice and experienced investors who wish to hone their skills and build a robust investment portfolio.

3. One Up On Wall Street by Peter Lynch

Peter Lynch, the former manager of the Magellan Fund at Fidelity Investments, shares his extensive knowledge and experience in One Up On Wall Street. Lynch encourages individual investors to leverage their everyday experiences and observations to discover investment opportunities that might go unnoticed by Wall Street. With a perfect blend of humor and insight, he simplifies the complexities of the stock market and provides actionable advice on how to spot promising companies and construct a robust investment portfolio.

Lynch’s approach is particularly appealing because it empowers the average person to become a savvy investor without needing a financial background.

By focusing on what you know and observe, you can make informed decisions that could lead to substantial gains. Lynch’s strategies are not just theories but are backed by his successful tenure at one of the world’s most successful mutual funds.

4. The Lifestyle Investor by Justin Donald

In “The Lifestyle Investor,” Justin Donald challenges the traditional notion of retirement and encourages readers to pursue financial freedom on their own terms. Through real-life examples and actionable strategies, he shows how anyone can create passive income streams and design a lifestyle that aligns with their values and aspirations. Whether you dream of traveling the world, spending more time with family, or pursuing your passions, this book offers a roadmap for achieving financial independence without the constraints of a 9-to-5 job.

Justin Donald has mastered the low-risk cash flow investment principles he shares with entrepreneurs around the world. His alternative investing principles not only provide a path to financial independence but also ensure a balanced life, free from financial worries.

5. Think and Grow Rich by Napoleon Hill

Think and Grow Rich is a timeless self-help book by Napoleon Hill, focusing on the principles of success and wealth accumulation. It’s based on Hill’s study of the habits of millionaires and condenses their secrets of success into clear, actionable principles.

What You’ll Learn:

Hill’s “13 Steps to Riches” include concepts like desire, faith, autosuggestion, and the power of the mastermind. First published in 1937, this book remains a classic in personal development and wealth creation. Napoleon Hill distills the success principles of some of the most accomplished individuals of his time into a practical guide for achieving your goals.

From setting clear objectives to mastering the art of persistence, Hill’s insights continue to inspire generations of readers to unlock their full potential and attain financial abundance.

6. The Midas Touch by Donald J. Trump and Robert T. Kiyosaki

In “The Midas Touch,” Donald Trump and Robert Kiyosaki combine their extensive experience in business and investing to provide readers with insights on wealth-building and entrepreneurship. This book is not just about making money; it’s about cultivating a mindset of abundance and seizing opportunities in economic challenges. The authors share personal anecdotes and lessons that are crucial for anyone looking to thrive financially.

The book encourages a proactive approach to financial growth, urging readers to think big and act boldly.

While the book may provoke mixed reactions due to the authors’ polarizing public figures, it undeniably offers valuable perspectives on navigating the complex world of finance.

7. Rich Dad Poor Dad

‘Rich Dad Poor Dad’ by Robert Kiyosaki is not just a book; it’s a revolutionary approach to financial education. This book dives deep into the contrasting mentalities towards money and investment between Kiyosaki’s two dads: his biological father (‘poor dad’) and the father of his best friend (‘rich dad’). The narrative beautifully illustrates how these differing perspectives shaped his understanding of money and investing.

The book is celebrated for its ability to challenge conventional wisdom about finances. It emphasizes learning about money through real-world experiences rather than traditional academic routes. Here are some key takeaways:

Explode the myth that you need a high income to be rich.

Schools often don’t equip students with real financial skills.

Understanding the difference between assets and liabilities is crucial.

It’s essential to view money through various perspectives to achieve financial freedom.

‘Rich Dad Poor Dad’ is a must-read for anyone looking to understand the real fundamentals of personal finance and wealth building.

By integrating these principles, readers can start to see the benefits of financial books in shaping a wealthy mindset, making informed financial decisions, and ultimately achieving financial independence.

Dive into the financial wisdom of ‘7. Rich Dad Poor Dad’ and uncover the secrets to wealth and success. For more insightful articles and expert advice, visit our website and explore a world of knowledge waiting for you. Click here to learn more and join our community of forward-thinkers!

Conclusion

As we wrap up our exploration of the top financial books to read in 2024, remember that each book offers a unique lens through which to view and improve your financial landscape. Whether you’re a seasoned investor or just starting out, these books provide valuable insights and actionable advice to help you navigate the complexities of personal finance and wealth building. Embrace the knowledge they offer, and may your journey through 2024 be both enlightening and prosperous. Happy reading!

Frequently Asked Questions

Why should I read financial books?

Reading financial books equips you with the knowledge and strategies to manage your finances effectively, helping you make informed decisions and reach your financial goals.

How can ‘The Richest Man in Babylon’ help me financially?

‘The Richest Man in Babylon’ provides timeless wisdom on saving, investing, and financial planning, teaching you how to secure and grow your wealth.

What makes ‘The Intelligent Investor’ a must-read?

‘The Intelligent Investor’ by Benjamin Graham is renowned for its foundational investment advice and strategies, making it essential for anyone looking to understand the stock market and invest wisely.

Can ‘Think and Grow Rich’ actually make me rich?

‘Think and Grow Rich’ focuses on the power of personal beliefs and the role they play in achieving personal and financial success. It’s more about shaping a wealth mindset than direct financial advice.

What is unique about ‘Rich Dad Poor Dad’?

‘Rich Dad Poor Dad’ contrasts different attitudes towards money and investing, offering insights into how wealthy people think about and manage money differently than the average person.

Are these books suitable for beginners in finance?

Yes, these books are written to be accessible for beginners, providing clear explanations and actionable advice to help anyone start their financial education.

Heading Title

-

Introduction Are you dreaming of saying “I do” as nature wakes up from winter? Planning a ceremony in early spring offers a unique blend of crisp air and blooming beauty, …

-

Introduction Planning a bridal shower theme can feel overwhelming especially when every bride deserves something uniquely hers. Whether you’re organizing an intimate garden gathering or a glamorous celebration, the right …

-

Introduction Choosing a wedding ring is a deeply personal journey, especially when you are drawn to the intricate storytelling of the past. For many brides-to-be, modern mass-produced rings often lack …

-

Introduction Planning a wedding bouquet shouldn’t feel overwhelming yet for so many brides, the sheer volume of floral options creates exactly that. If you’re drawn to calm, intentional beauty over …

-

Introduction Your wedding bouquet is the one accessory you’ll carry down the aisle, hold in every photo, and remember forever — so it had better be breathtaking. A tulip wedding …

-

Introduction Planning an outdoor wedding in February sounds risky when conventional wisdom insists winter ceremonies belong indoors. However, dismissing February outdoor weddings means missing opportunities for breathtaking winter landscapes, off-season …