Investing in a 401(k) or an Individual Retirement Account (IRA) is a pivotal step towards securing a financially stable retirement. These investment vehicles offer unique benefits and can be pivotal in growing your retirement savings. Understanding their features, benefits, and strategic use can greatly enhance your financial planning for the golden years.

Table of Contents

ToggleKey Takeaways

401(k)s and IRAs both offer significant tax benefits, but understanding their differences is crucial for optimal retirement planning.

Combining contributions to both 401(k)s and IRAs can maximize retirement savings and financial flexibility.

IRAs generally offer a wider range of investment options compared to 401(k)s, allowing for more personalized investment strategies.

Employer matching in 401(k)s represents a key benefit, effectively providing ‘free money’ to boost your retirement funds.

Deciding between a 401(k) and an IRA often depends on individual financial circumstances, but contributing to both, if possible, can offer the best of both worlds.

Exploring the Basics of 401(k)s and IRAs

What is a 401(k)?

A 401(k) is an employer-sponsored retirement plan that allows employees to save for retirement while benefiting from tax advantages. Participants can choose to defer a portion of their salary into their 401(k) account, which can be invested in a range of options such as stocks, bonds, and mutual funds.

What is an IRA?

An Individual Retirement Account (IRA) offers individuals a way to save for retirement outside of employer-sponsored plans. IRAs also provide tax advantages and can invest in similar assets as 401(k)s. There are several types of IRAs, including Traditional and Roth, each with its own tax implications.

Key differences between 401(k)s and IRAs

Contribution Limits: 401(k)s generally have higher contribution limits compared to IRAs.

Tax Treatment: Contributions to 401(k)s are typically made with pre-tax dollars, whereas IRAs can be funded with pre-tax (Traditional) or post-tax (Roth) dollars.

Employer Match: Many employers offer a match on 401(k) contributions, which is not available with IRAs.

Investment Options: While both account types offer a variety of investment choices, 401(k)s are often limited by the options provided by the employer.

Both 401(k)s and IRAs are pivotal in planning for a financially secure retirement, offering distinct benefits and limitations that should be carefully considered.

Maximizing Your Retirement Savings

Benefits of combining 401(k) and IRA contributions

Combining contributions to both a 401(k) and an IRA can significantly enhance your retirement savings and provide more flexibility in managing your tax liabilities. By diversifying your retirement strategies, you can maximize the benefits each account offers, such as different tax advantages and withdrawal rules.

How to maximize contributions

To truly maximize your retirement contributions, start by assessing your financial situation and setting a realistic savings goal. Consider automating your contributions to ensure consistency and to avoid the temptation to skip a month. If possible, aim to contribute the maximum allowable amount to each account annually to take full advantage of tax benefits and compound interest.

Strategies for early and consistent saving

The key to building a substantial retirement nest egg is starting early and saving consistently. Create a disciplined savings plan that defines your retirement goals and includes a monthly savings amount. Utilize tools like retirement calculators or seek advice from financial planners to tailor your plan effectively. Remember, the earlier you start, the more you can benefit from the power of compound interest over time.

Tax Advantages of 401(k)s and IRAs

Understanding tax benefits

Both 401(k)s and IRAs offer significant tax benefits that can enhance your retirement savings. Contributions to these accounts are often tax-deductible, reducing your taxable income for the year. This immediate tax relief provides more funds to grow through compound interest over time.

Comparing Roth and Traditional options

Choosing between a Roth and Traditional account depends on your current and expected future tax situations. Roth accounts are funded with after-tax dollars, meaning withdrawals during retirement are tax-free. Traditional accounts, on the other hand, use pre-tax dollars and defer taxes until withdrawal, which can be beneficial if you expect to be in a lower tax bracket in retirement.

How contributions affect your tax bracket

Contributing to a 401(k) or IRA can potentially lower your current tax bracket, offering immediate financial benefits. This reduction in taxable income can be particularly advantageous for those nearing a lower tax bracket, providing an incentive to increase contributions.

By strategically planning your contributions, you can maximize the tax advantages offered by these retirement accounts, ensuring a more secure financial future.

Investment Options and Flexibility

Diverse investment choices with IRAs

IRAs provide a broad spectrum of investment options, often surpassing those available through employer-sponsored 401(k) plans. Investors can choose from stocks, bonds, mutual funds, ETFs, and more, ensuring a tailored investment strategy that aligns with their financial goals and risk tolerance. This flexibility is crucial for those seeking to diversify their portfolios and potentially enhance returns over the long term.

Limitations of 401(k) investment options

401(k) plans typically offer a more limited selection of investment choices, usually curated by the plan’s sponsor to align with general employee risk profiles. While this can simplify the investment process for participants, it may also restrict opportunities to fully customize one’s investment approach. For those looking for more investment options and greater account flexibility, rolling over 401(k) assets into an IRA might be a beneficial strategy.

How to choose investments for your retirement accounts

Selecting the right investments for your retirement accounts involves understanding your financial goals, risk tolerance, and the investment options available to you. It’s advisable to start with a clear assessment of your long-term financial needs and consult with a financial advisor to map out a strategy that includes both 401(k) and IRA contributions. Diversifying your investments across different asset classes can help manage risk and increase the potential for growth.

Navigating Contribution Limits and Rules

Annual contribution limits for 401(k) and IRA

For those planning their retirement contributions, understanding the annual limits is crucial. In 2023, individuals under age 50 can contribute up to $22,500 to their 401(k) and $6,500 to their IRA. These limits increase slightly in 2024 to $23,000 and $7,000 respectively. For those 50 and older, the limits are higher to allow for ‘catch-up’ contributions, reaching $30,000 for 401(k)s and $7,500 for IRAs in 2023, and $30,500 and $8,000 in 2024. These adjustments ensure that individuals can continue to invest adequately towards their retirement, adjusting for inflation and changes in economic conditions.

Rules for withdrawals and loans

Navigating the rules for withdrawals and loans from your retirement accounts is essential for effective financial planning. Withdrawals from a 401(k) before the age of 59 1/2 typically incur a 10% penalty, although exceptions exist for hardships and other specific circumstances. Loans are permitted from 401(k) plans but must be repaid with interest to avoid being treated as taxable distributions. IRAs do not generally allow loans, and early withdrawals can also be penalized unless qualifying conditions are met.

Impact of income on IRA deductibility

The ability to deduct IRA contributions on your tax return can be affected by your income level, especially if you or your spouse are covered by a workplace retirement plan. For 2023, the phase-out range for deductibility starts at $73,000 for single filers and $116,000 for married couples filing jointly. Contributions to a Roth IRA are also subject to income limits, which may restrict the ability to contribute for high earners. This makes it imperative to plan contributions based on not only the IRS limits but also your personal financial situation.

The Role of Employer Matching in 401(k)s

Understanding Employer Matching

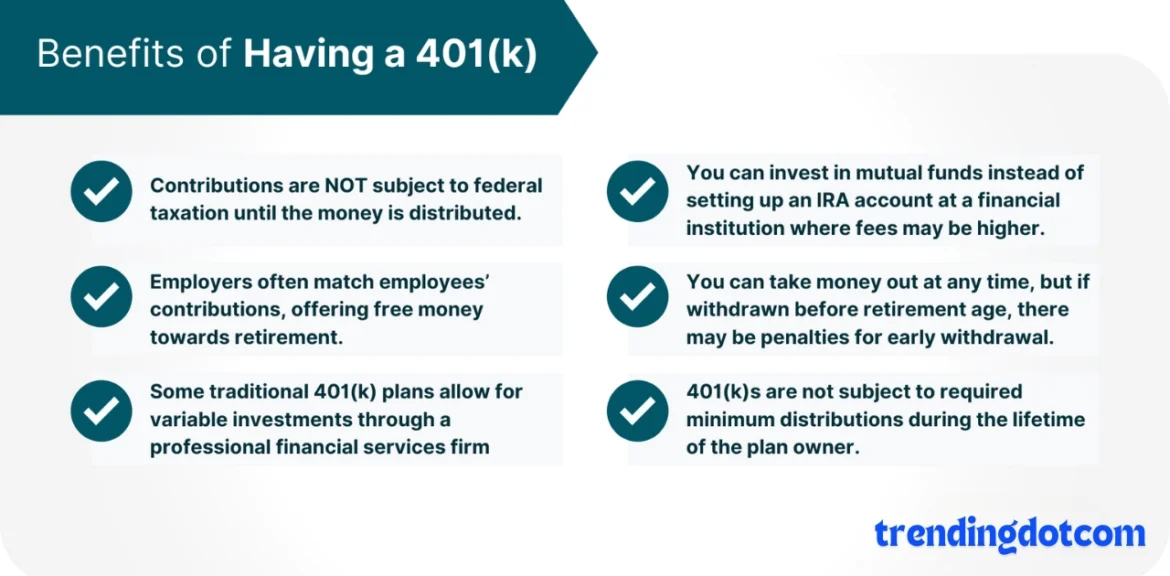

Employer matching contributions to a 401(k) are a significant incentive for employees to participate in the plan. Many employers provide a matching contribution for some or all of an employee’s 401(k) contribution. This is often seen as one of the biggest benefits of a 401(k) because it is essentially free money added to your retirement savings. The typical arrangement involves the employer matching a portion of the amount you save, up to a certain percentage of your earnings.

How to Take Full Advantage of Matching Funds

To fully benefit from employer matching, employees should aim to contribute at least enough to receive the full match offered by their employer. This often means contributing a percentage of your salary that meets or exceeds the employer’s matching threshold. For example, if an employer matches contributions up to 6% of your salary, you should contribute at least that amount to maximize the benefit.

It is crucial to understand the specifics of your employer’s matching program, as these can vary significantly. Always check your employee benefits handbook or consult with your HR department for details.

Comparing Employer Contributions in 401(k)s and IRAs

While 401(k)s often come with the possibility of employer matching, IRAs do not offer this benefit. This distinction makes 401(k)s particularly attractive for employees whose employers offer generous matching contributions. The average employer match is around 4.5%, but this can vary widely. In contrast, IRAs rely solely on individual contributions, emphasizing the unique advantage of 401(k)s in employer-supported retirement savings.

Making the Right Choice: 401(k) vs IRA

Factors to consider when choosing

When deciding between a 401(k) and an IRA, consider factors such as your current income, expected retirement needs, and whether your employer offers a matching contribution. Employer contributions can significantly enhance the value of a 401(k), making it a compelling option for those with this benefit.

Benefits of having both accounts

Having both a 401(k) and an IRA can provide a diversified retirement strategy. This approach allows you to take advantage of the tax benefits of both account types while maximizing your potential retirement savings.

When to prioritize one over the other

Prioritize a 401(k) if your employer offers a substantial match; this is essentially free money. Conversely, an IRA might be preferable if you seek more investment options or if you’re self-employed. Each choice has distinct advantages depending on your personal financial situation and retirement goals.

Deciding between a 401(k) and an IRA can be a daunting task. Each has its benefits and limitations, which can significantly impact your financial future. To help you make the most informed decision, visit our website where we delve deeper into the pros and cons of each option. Don’t miss out on securing your financial future—learn more today!

Conclusion

In wrapping up, whether you choose a 401(k), an IRA, or a combination of both, each offers unique benefits that can significantly enhance your retirement savings. The key is to understand your financial goals, assess the investment options available, and make informed decisions that align with your retirement plans. Remember, the earlier you start investing in these retirement accounts, the more you can leverage the power of compound interest. So, take action today to secure a comfortable and financially stable retirement.

Frequently Asked Questions

What is the main difference between a 401(k) and an IRA?

The main difference is that a 401(k) is an employer-sponsored retirement plan, while an IRA (Individual Retirement Account) is set up individually through a bank or brokerage firm. IRAs typically offer more investment options, while 401(k)s usually allow higher annual contributions.

Can I have both a 401(k) and an IRA?

Yes, you can have both a 401(k) and an IRA. Having both can maximize your retirement savings and tax advantages, as they each offer unique benefits and contribution limits.

What are the tax benefits of investing in a 401(k) or IRA?

Both 401(k)s and IRAs offer tax benefits. Contributions to these accounts can be tax-deductible, reducing your taxable income. Additionally, investments grow tax-deferred until withdrawal in retirement.

How do I maximize my contributions to a 401(k) and IRA?

To maximize contributions, start by contributing enough to your 401(k) to get any employer match, which is essentially free money. Then, contribute as much as possible to an IRA. If possible, aim to max out contributions to both types of accounts to take full advantage of tax benefits and compound growth.

What investment options do I have with an IRA compared to a 401(k)?

IRAs generally offer a wider range of investment options than 401(k)s, allowing for more personalized investment strategies. You can choose from a variety of stocks, bonds, mutual funds, and ETFs, unlike 401(k)s which may have limited choices due to employer-selected options.

Should I choose a Roth or Traditional IRA?

The choice between a Roth or Traditional IRA depends on your current tax rate, expected future income, and retirement goals. Roth IRAs offer tax-free withdrawals in retirement, while Traditional IRAs provide a tax break at the time of contribution. Consider your financial situation and retirement strategy to decide.

Heading Title

Samsung recently announced significant goals for its most recent semiconductor nodes, chipset design, and advanced 3D integration technologies. By improving performance, reducing power consumption, and making it possible to produce …

Table of Contents Toggle Diablo IV- How You Can Download, Play & WinHow to Download Diablo IVPlatform OptionsSteps to Download on PCHow to Download Diablo IV on ConsolesXbox One & …

Table of Contents Toggle How to Make Money with Forex Trading for BeginnersWhat is Forex Trading?Why Trade Forex?Getting Started with Forex TradingLearn the BasicsChoose a Reliable BrokerOpen and Fund Your …

Table of Contents Toggle Crypto scams evolve with AI, posing new threats to investorsKey TakeawaysThe Rise of AI-Enhanced Crypto ScamsAI-Powered Security Solutions for CryptoReal-Time Threat DetectionAnomaly Detection in TransactionsFlagging Suspicious …

Table of Contents Toggle Safest Ways To Store Your Cryptocurrency In 2025Understanding Different Types of Crypto WalletsHardware WalletsSoftware WalletsPaper WalletsChoosing a Reputable Wallet ProviderImplementing Strong Security MeasuresUsing Two-Factor AuthenticationCreating Strong …

- BlogFinance

Unlocking the Potential of Crypto Exchange Development: Building the Future of Digital Asset Trading

by Asifby AsifTable of Contents Toggle Build the future of digital asset trading with crypto exchangeThe Evolution of Crypto ExchangesEarly Beginnings and MilestonesCurrent Landscape and TrendsFuture ProspectsKey Features of Modern Crypto ExchangesSecurity …